Environmental, Social, and Governance (ESG) metrics are increasingly central to how businesses, investors, and regulators evaluate the broader impact of corporate operations (Gorley, 2022). Rooted in the concept of sustainability, ESG metrics go beyond traditional financial analysis by incorporating factors that reflect a company’s long-term environmental stewardship, social responsibility, and governance practices. This blog explores what ESG metrics are, why they matter, and how they are used.

The Origins of ESG and Triple Bottom Line

The term ESG was introduced in 2004 by the United Nations as a framework to address sustainability-related risks and opportunities. A decade earlier, in 1994, economist John Elkington introduced the concept of the Triple Bottom Line (TBL), which encouraged businesses to focus on three pillars: people, planet, and profit. While TBL laid the groundwork for thinking about sustainability in corporate contexts, it was often seen as vague and hard to quantify. Today, ESG metrics build on the TBL framework, providing clear, quantifiable metrics that guide decisions for businesses, investors, employees, and consumers (IFC, 2004; Elkington, 2013).

Understanding ESG Metrics

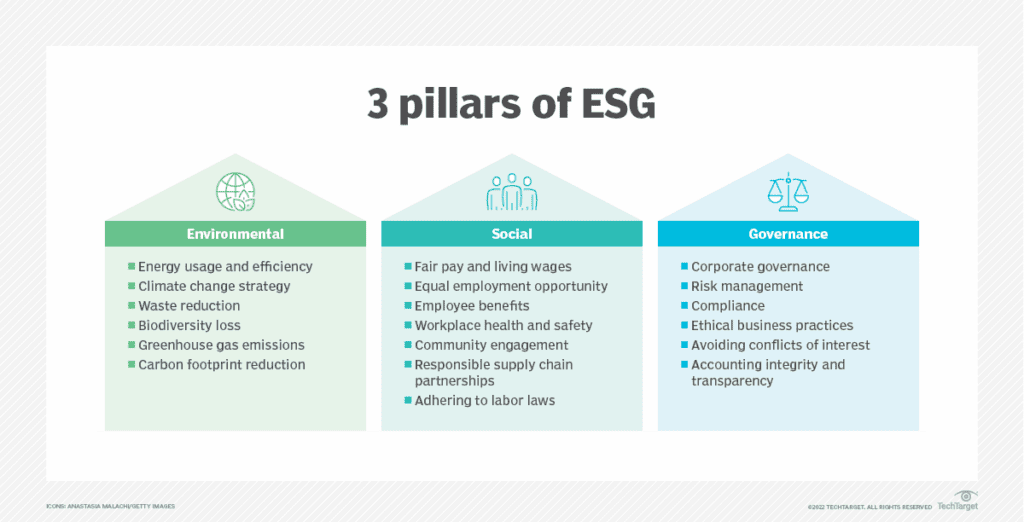

ESG metrics are quantitative and qualitative indicators that measure a company’s performance across three key dimensions (Stedman and Paul, 2024):

- Environmental: These metrics assess how a company interacts with the natural world. Common examples include carbon emissions, energy efficiency, water usage, waste management, and biodiversity impact. For instance, companies often report on their greenhouse gas (GHG) emissions (Villinski and Young, 2024) divided into Scope 1, 2, and 3 emissions—to indicate their carbon footprint.

- Social: Social metrics evaluate how a company manages relationships with employees, customers, suppliers, and the communities in which it operates (Paul, 2024). This includes data on employee diversity, equity, and inclusion (DEI), labor practices, customer satisfaction, and community engagement. For example, tracking the gender pay gap or the percentage of underrepresented groups in leadership positions are common social metrics.

- Governance: Governance metrics examine the frameworks and practices that guide a company’s decision-making and accountability (WEF, 2022). This includes board diversity, executive compensation, shareholder rights, and policies against corruption and bribery. For example, the presence of an independent board of directors is a governance factor often scrutinized by investors.

Why Are ESG Metrics Important?

A decade ago, when I started teaching at Unity Environmental University (then Unity College), most of my students were eager to confront environmental challenges and contribute to a more sustainable society. However, they primarily thought of this in terms of reducing their personal footprints—by adopting a plant-based diet, eschewing plastic packaging, carpooling, or growing their own vegetables. They weren’t yet thinking of themselves as employees or investors. At the time, concepts like the Triple Bottom Line seemed abstract and primarily the concern of companies.

Now, ESG metrics have risen to prominence, providing businesses, investors, and consumers with quantifiable ways to shape their decisions. The Global Sustainable Investment Review of 2022 reported that $30.3 trillion is now invested in sustainable assets globally. Major professional services firms, including Deloitte and McKinsey, note that ESG metrics help investors understand and manage risks, and help investment service providers meet the increasing demand for responsible, sustainable investment portfolios (Taylor and Collins, 2022; Gelb, et al., 2023).

How Are ESG Metrics Used?

Companies, investors, and stakeholders use ESG metrics in various ways:

- Corporate Strategy: Businesses integrate ESG metrics into their strategies to align operations with sustainability goals and address concerns of interested an affected parties (FTI, 2024). For example, setting science-based targets for GHG reduction reflects a company’s commitment to environmental responsibility.

- Investor Analysis: Institutional investors use ESG data to evaluate companies and assess potential risks and opportunities. Tools like the MSCI ESG Ratings or Sustainalytics provide detailed ESG evaluations for investors. Increasingly, investors are demanding insights into sustainability-related risks, using ESG data to guide their decisions (Taylor and Collins, 2022).

- Consumer Transparency: Companies disclose ESG metrics through sustainability reports or frameworks like the Global Reporting Initiative (GRI) or Task Force on Climate-related Financial Disclosures (TCFD). These disclosures help consumers make informed decisions (Field, 2024).

Why ESG Knowledge Matters for Professionals

In today’s job market, having expertise in ESG can significantly enhance an individual’s employability. According to ESG News (2024), demand for employees with green skills outpaces supply significantly. In the United States, a person with green skills is 80% more likely to be hired, and globally, nearly 25% of jobs seeking green-skilled employees are in the utilities industry. Sustainable procurement skills are particularly sought after.

Employers across industries are seeking professionals who understand ESG principles and can apply them to drive sustainable business practices. Whether it’s helping a company reduce its carbon footprint, implementing diversity initiatives, or ensuring compliance with new regulations (Marks, 2023; US SEC, 2024) ESG skills are highly valued.

If you’re looking to enhance your ESG knowledge and skills, Unity Environmental University’s baccalaureate and masters degree programs offer comprehensive training and credentials that prepare you to excel in this dynamic field. From courses in sustainable business practices to specialized microcredentials, we help you build expertise that employers value. Explore our programs to gain in-demand skills and take your career to the next level.

References:

Dathe, T., Helmold, M., Dathe, R., Dathe, I. (2024). ESG Metrics. In: Implementing Environmental, Social and Governance (ESG) Principles for Sustainable Businesses. Responsible Leadership and Sustainable Management. Springer, Cham. https://doi.org/10.1007/978-3-031-52734-0_12

Elkington, J. B. (2013). Enter the triple bottom line. In A. Henriques & J. Richardson (Eds.), The triple bottom line: Does it all add up? DOI:10.4324/9781849773348-8

ESG News. (2024). Global demand for green talent outpaces supply. Retrieved from https://esgnews.com/global-demand-for-green-talent-outpaces-supply-linkedin-report/

Field, K. (2024). ESG due diligence: Mitigating risks and unlocking value. FTI Consulting. Retrieved from https://www.fticonsulting.com/insights/articles/esg-due-diligence-mitigating-risks-unlocking-value#:~:text=Holistic%20ESG%20due%20diligence%20addresses,ESG%20initiatives%20and%20business%20transformation.

FTI Consulting. (2024). ESG due diligence: Mitigating risks and unlocking value. Retrieved from https://www.fticonsulting.com/insights/articles/esg-due-diligence-mitigating-risks-unlocking-value#:~:text=Holistic%20ESG%20due%20diligence%20addresses,ESG%20initiatives%20and%20business%20transformation.

Gelb, D., McCarthy, K., Rehrm, S., & Voronin, K. (2023). Investors want to hear from companies about the value of sustainability. McKinsey & Company. Retrieved from https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/investors-want-to-hear-from-companies-about-the-value-of-sustainability

Global Sustainable Investment Alliance. (2022). Global sustainable investment review. Retrieved from https://www.gsi-alliance.org/wp-content/uploads/2023/12/GSIA-Report-2022.pdf

Gorley, L. (2022). What is ESG and why is it important for risk management? Sustainalytics. Retrieved from https://www.sustainalytics.com/esg-research/resource/corporate-esg-blog/what-is-esg-why-important-risk-management#:~:text=Broadly/

International Finance Corporation. (2004). Who Cares Wins: Connecting financial markets to a changing world. World Bank Group. Retrieved from https://documents1.worldbank.org/curated/fr/444801491483640669/pdf/113850-BRI-IFC-Breif-whocares-PUBLIC.pdf

Marks, J. (2023). New EU sustainability reporting rules: How impacted U.S. companies can prepare. Deloitte. Retrieved from https://deloitte.wsj.com/sustainable-business/new-eu-sustainability-reporting-rules-how-impacted-us-companies-can-prepare-01675110236?reflink=desktopwebshare_permalink

Paul, C. (2024). 5 ways organizations can address the social factors of ESG. TechTarget. Retrieved from https://www.techtarget.com/sustainability/feature/5-ways-organizations-can-address-the-social-factors-of-ESG

Stedman, M., & Paul, C. (2024). Top ESG reporting frameworks: Explained and compared. TechTarget. Retrieved from https://www.techtarget.com/sustainability/feature/Top-ESG-reporting-frameworks-explained-and-compared

Taylor, A., & Collins, R. (2022). ESG investing and sustainability: Preparing for change. Deloitte Insights. Retrieved from https://www2.deloitte.com/us/en/insights/industry/financial-services/esg-investing-and-sustainability.html

United States Securities and Exchange Commission. (2024). SEC proposes rules to enhance and standardize climate-related disclosures for investors. Retrieved from https://www.sec.gov/newsroom/press-releases/2024-31

Villinski, M., & Young, J. (2024, December). What is Carbon Accounting and Why Should Your Business Care Unity Environmental University Distance Education Blogs. Retrieved from https://unity.edu/distance-education-blogs/carbon-accounting/

World Economic Forum. (2022). Defining the G in ESG. Retrieved from https://www3.weforum.org/docs/WEF_Defining_the_G_in_ESG_2022.pdf

This blog was written by Dr. Jennifer Cartier with the assistance of AI language model ChatGPT (OpenAI, 2024) to brainstorm ideas, optimize SEO, and format references in the creation of this work.